The Year in Review

Salisbury University experienced a 4.0% enrollment decline in FY23. Since FY20, enrollment has declined 17.8%. Fall 2023 enrollment has declined about 1% from Fall 2022, and revenue was budgeted at an enrollment decline of 3% for FY24. The revenue decline associated with lower enrollment and historically lower densities in housing/dining is no longer offset with the federal Higher Education Emergency Relief Fund (HEERF), but it is mitigated by organic and related expense reductions and increases in state general funds, most of which have gone to COLA/merit increases. The unrestricted net position is up $4 million, of which $1.8 million is the net pension impact. Cash increased $1.4 million.

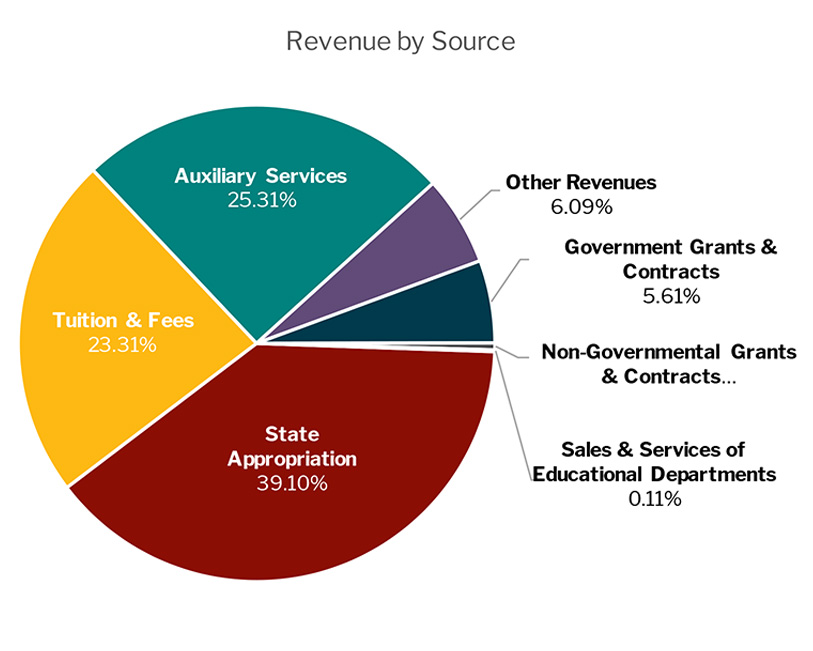

Revenue Distribution

Fiscal Year 2023

Revenue Distribution

Fiscal Year 2023

University Financial Report

Fiscal Year 2023

| Revenues FY23 | |

| Tuition & Fees | $46,890,586 |

| State Appropriation | $78,645,174 |

| Government Grants & Contracts | $11,278,513 |

| Non-governmental Grants & Contracts | $942,910 |

| Sales & Services of Educational Departments | $230,163 |

| Other Revenues | $12,259,115 |

| Auxiliary Services | $50,910,582 |

| Total Revenues | $201,157,043 |

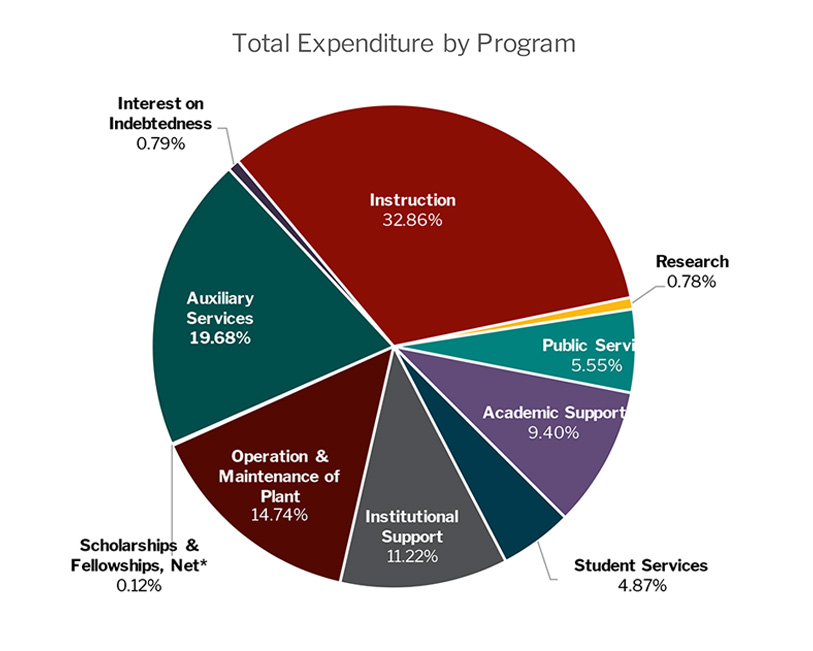

| Expenses | |

| Education & General: | |

| Instruction | $66,107,370 |

| Research | $1,562,359 |

| Public Service | $11,168,370 |

| Academic Support | $18,911,732 |

| Student Services | $9,793,519 |

| Institutional Support | $22,564,001 |

| Operation & Maintenance of Plant | $29,649,468 |

| Scholarships & Fellowships, Net* | $247,065 |

| Auxiliary Services | $39,589,097 |

| Interest on Indebtedness | $1,598,959 |

| Total Expenses | $201,191,940 |

| Net Increase (Decrease) in Fund Balance | $(34,897) |

* SU’s gross scholarships and fellowships are $24.5M

Please note: The financial information displayed is based on the University’s submission to the University System of Maryland (USM) and is published prior to either the USM’s or the external auditor’s final review. As such, any subsequent changes that may have been requested and/or made are not reflected.